A bit of perspective on a buzzword.

The prompt

The Axioma Quant Forum in London included a discussion of smart beta. I took two highlights from it: a point of view and a question.

The point of view was stated by Gerben de Zwart: “Smart beta seems like a replay of simple quant strategies of the past when not carefully implemented.”

The question: Who should decide on the beta mechanism? Pensions? Buy-side? Sell-side? Others?

Background

The first thing to settle is what “smart beta” means. That’s hard since there doesn’t seem to be agreement. The “beta” comes from the Capital Asset Pricing Model. If it were meaning beta as in a number, then “smart beta” would be a malapropism. But it uses “beta” more abstractly as in “market exposure”.

No surprise that the general concept has multiple names, such as: alternative beta, new beta, advanced beta, enhanced beta, beta plus.

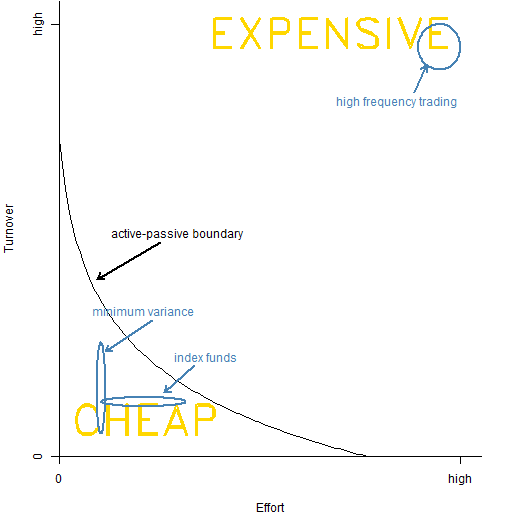

Another associated word is “passive”. Figure 1 is stolen from “What does ‘passive investing’ really mean?”. Smart beta is an attempt to be passive yet retain some advantage of being active.

Figure 1: Schematic view of passive versus active management.  Smart beta inhabits the borderland between active and passive. Some people include low volatility strategies in smart beta. A key component of smart beta is fundamental indices.

Smart beta inhabits the borderland between active and passive. Some people include low volatility strategies in smart beta. A key component of smart beta is fundamental indices.

Strategies

“Passive”, “beta”, “smart beta” are all generally following some specific index. Market cap weighted indices have an advantage in that there is not a need to rebalance when tracking them. Hence they have an easier time pretending that they are not a trading strategy. But indeed they are.

Hardly anyone is going to be fooled into believing that smart beta schemes aren’t a trading strategy. Another name for smart beta has to be dumb alpha*. That may not find much favor from marketing teams though. Taking the spin off is perhaps a good test: if an asset owner is comfortable buying something described as dumb alpha, then it might well be suitable for them.

The aim of smart beta is to get good results with little decision-making effort. This will be minimal effort from the owners of the money, and not a lot of effort from anyone else so that fees will be small. I hear rumor that not all smart beta funds are as cheap as might be expected.

So what does “good results” mean? “Good” is relative. When a strategy significantly underperforms an alternative strategy, then that strategy is going to lose assets. Low volatility strategies are disposed to outperform in bear markets and underperform in rising markets. This is the right way round — withdrawals are not likely to be so bad when there is underperformance but returns are positive. However strategies that underperform in falling markets are going to be infested with teflon money.

There’s one class that is probably most vulnerable. Strategies based on a single, constant factor — naive quant strategies — are subject to underperformance for extended periods of time. Markets are dynamic.

While “market exposure” is ill-defined, it is related to another piece of vocabulary: “diversity”. If there is diversity, then underperformance is unlikely to be extreme. Smart “smart beta” will pay attention to diversification. Asset owners might consider diversifying by combining multiple smart beta strategies.

The second dimension in Figure 1 is turnover, which the ultimate owners should be concerned about. Turnover will remain higher than it probably should be as long as there is a focus on following indices. If the explosion of indices advances the idea that indices are arbitrary and shouldn’t be taken so seriously, then smart beta will have been beneficial.

Predictions

There’s a prediction that 6,000,000,000,000 dollars will enter smart beta in the next 5 years. My prediction is that there will be 0 dollars in smart beta in 5 years.

Both predictions can be correct.

I think the next market crisis will contaminate “smart beta”. So while there may be substantial money in what is now called smart beta, the term won’t be used then.

Resources

The following links have some thought behind them.

“Understanding Smart Beta” from Towers Watson.

“How Smart is ‘Smart Beta’ Investing?” from Robeco.

“Smart Beta 2.0” from Edhec.

Epilogue

Hey Jack, now for the tricky part

When you were the brightest star

Who were the shadows?

from “Hey Jack Kerouac” by Natalie Merchant and Robert Buck

* I was disappointed but not surprised that I was not the first to think of this phrase.

Ha! I will point you towards another historic link, Beating Benchmarks with no skill. A precursor to the Frazzini and Pedersen

Betting Against Beta

I should know because I coded it. Interestingly a good amount of effort under the hood. The instruments were treasuries and part of the idea is to capture the full covariance, so I constructed a shrinkage covariance. This was 1998 and Ledoit Wolf came out in 2001. Necessity is the mother of invention!

Naive quant strategies (Momentum, Size and Value) are finding traction as ETF’s for Institutional exposure to risk premia. See Antti Illmanen’s Expected Returns, and Ang, Goetzmann and Schaefer’s paper for the Norwegian Sovereign Wealth Fund. That they are poorly diversified is desirable in this case.

You also have a post somewhere reviewing the LQG’s debate on fundamental indexation, your points here are valid there as well.

Best regards, Louis

Louis,

Thanks.

Actually Ledoit had an earlier paper shrinking towards the market that would have been around if you had found it.

I’m okay with people using naive quant strategies. But I think they need to be watched and thought about, thus I don’t see them as useful for smart beta. If you want something that you don’t want to think about, then it should be diversified or dynamic (for the latter see, for instance, QLABinvest).

Pingback: Monday links: promoting low-cost investing | Abnormal Returns

Pingback: Hot Links: Dumb Alpha | The Reformed Broker

Pingback: Blog year 2013 in review | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics