Summary

Do performance attribution the traditional way with one exception: instead of using an index as the benchmark, use a number of random benchmarks that pertain specifically to a particular set of decisions.

Description

Performance is about decisions. You can learn about a specific set of decisions made in your portfolio by do trading that obeys all the constraints of the portfolio but does random trading in place of the decisions in which you are interested.

Compared to traditional methods, this is both more focused and more informative.

The analysis is specific to the set of decisions that are replaced by random ones. The analysis is based on a large number of benchmarks, not just one. Hence how significant the results are is an inherent part of the analysis.

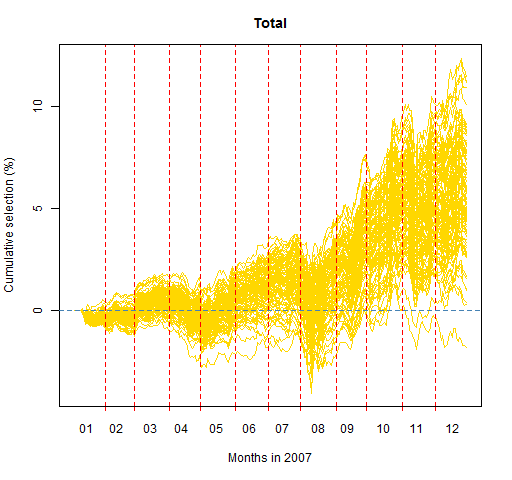

Figure 1 shows an example from an attribution analysis on sectors.

Figure 1: Whole portfolio asset selection effect over a one-year period.  This shows the cumulative selection effect from the start of the year for the portfolio. Selection varied from pretty good to not-so-good during the first part of the year, and then it became quite good by the end of the year. This is taken from the blog post “Discovering the quality of portfolio decisions”.

This shows the cumulative selection effect from the start of the year for the portfolio. Selection varied from pretty good to not-so-good during the first part of the year, and then it became quite good by the end of the year. This is taken from the blog post “Discovering the quality of portfolio decisions”.

See also

Portfolio Construction Process Attribution.

Pertinent blog posts

The performance category.

In particular, there is: