Summary

Create realistic portfolios with which to test and compare risk models.

Description

You can generate random portfolios that have constraints similar to the portfolios that you actually hold. With such portfolios you can:

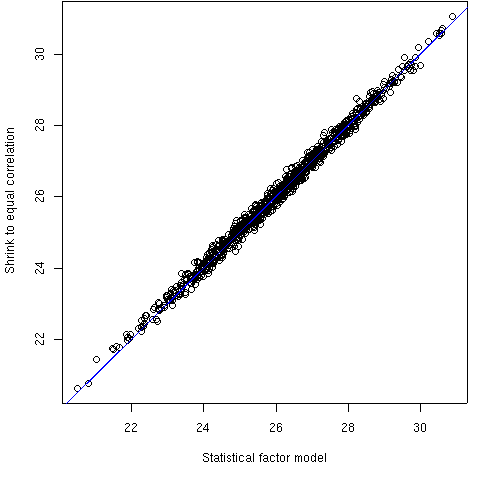

- Compare risk models (see Figure 1).

- Test model predictions versus realized values (see Figure 2).

- Look for weak spots in models by varying the constraints.

Figure 1: Predicted volatility from two risk models

Figure 1 compares the predictions from two risk models of 1000 equity portfolios with a certain set of constraints. One of the models is a statistical factor model, the other shrinks the sample variance towards the equal correlation matrix.

Figure 2: Correlation of predicted versus realized volatility

Figure 2 shows the correlation between the predicted volatility of a risk model (the shrinkage model) and the realized volatility for eight quarters. There are 1000 portfolios in each quarter. The portfolios are long-short dollar neutral.

See Also

A number of blog posts have been about testing risk models with random portfolios. For instance: