The paper “Economists’ Hubris — The case of equity asset management” (SSRN) by Shojai, Feiger and Kumar has achieved some measure of notoriety. It has mentions in the MoneyScience blog and in the Financial Times among other places.

A response to the article by Paul Kaplan of Morningstar is at Investment Week. If I may summarize that response briefly, it is: “stuff and nonsense”. But that is talking about aspects of the paper that I’m not particularly interested in at the moment.

The paper discusses a performance measure. The measure is to compare the return of a fund over a period with the return the fund would have had if they had not traded at all during the period. This, by the way, is not a new idea.

Before I completely trash it, let me first state that I think it’s rather a good idea. It is using conditional information to try to answer the question of whether or not the fund is exhibiting skill. A question that is habitually answered using hopelessly vague evidence.

If the fund performs better than if there were no trading, we mark that as good performance. One thing we don’t know is whether the difference is an outstanding achievement or well within the realms of luck.

But actually we know less than that. Suppose you had me as a fund manager. Then we would start off the period in the worst possible position, as illustrated below.

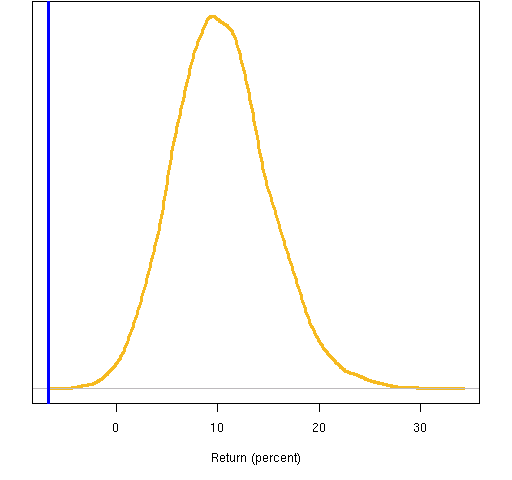

Figure 1: Returns of static portfolios over a period

The distribution in Figure 1 shows the possible returns from portfolios that are static throughout the time period. The blue line indicates the return of my starting portfolio. Note what this means regarding the performance measure.

I’m going to look good. I could have my cat — the stupid one — pick the trades, and I would still look good. For this period I can’t lose.

With a reasonable amount of additional work, we can learn ever so much more. Random portfolios using the shadowing method will tell us how significant the difference in returns between the actual fund and not trading really is. The scheme is to start with the portfolio at the start of the period (in fact, we don’t even need to know all of the positions) and do random trades throughout the period that obey the turnover of the actual fund.

We will get a distribution of returns conditional on the starting portfolio that is quite narrow (unless the turnover is massive). This is the distribution of returns from zero skill — what would have happened “by chance”.

If we look at a series of time periods, the measure advocated in the Hubris paper will give us a sign test — a series of pluses and minuses. The shadowing method will give us a percentile for each period. A quite powerful percentile because it is based on very specific information.

Firstly, as open funds can receive allocations from investors somewhat continuously (depending on addition/redemption terms); the benchmark could vary dramatically by date.

Secondly, just because an investor starts off in a particular portfolio by means of subscription, that does not imply that the portfolio would have been purchased by the manager had he been required to hold it for some fixed period. Based on my experience transacting institutional portfolio rebalances for a number of years, I would say that individual component durations are far from uniform.

Lastly, one utility of a benchmark is that it allows the investor access to an alternative allocation. If the investor has to rely upon the Manager to present the initial portfolio, it is unlikely that the investor would be able to construct the aforementioned portfolio without the assistance of the Manager, thereby invalidating the concept of the benchmark as a means of alternative allocation.

I present an alternative here

http://allaboutalpha.com/blog/2010/08/10/switching-horses-mid-race-how-to-know-when-riding-different-betas-creates-alpha/