A pictorial summary of “The Volume Clock: Insights into the High Frequency Paradigm” by David Easley, Marcos M. Lopez de Prado and Maureen O’Hara.

“HFT” means “high-frequency trading/trader”, “LFT” means “low-frequency trading/trader”.

Legend holds that Nathan Mayer Rothschild used racing pigeons to front run his competitors and trade on the news of Napoleon’s defeat at Waterloo a full day ahead of His Majesty’s official messengers

high-frequency traders have been characterized as ‘cheetah traders’, an uncomplimentary allusion to their speed and character. The reality is, as usual, more complex.

It would be a mistake, for example, to conflate the HFT strategies of cash equities and the HFT strategies of futures on equity indices. The reason is that HFT is not particularly related to macro factors (such as asset class), but it is intimately related to market microstructural factors.

Thinking in volume-time (or any other index of activity) is challenging for us humans. But for a ‘silicon trader’, it is the natural way to process information and engage in sequential, strategic trading.

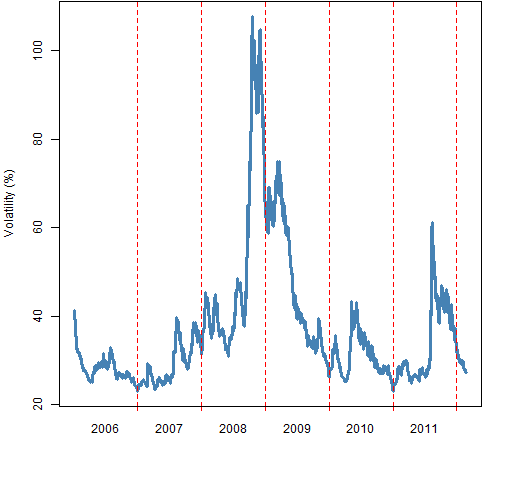

A HFT market maker has little use for a model that attempts to forecast volatility over a chronological time horizon, because she must keep her inventory under control in volume time

A chess player makes moves at different speeds during a game, depending on several factors: Superiority over the adversary, stage of the game, amount of material lost, computational power, experience with the existing position, time remaining before the end of the game, etc. It would make little sense for a chess player to attempt making moves every minute

Predatory algorithms constitute a very distinct species of informed traders, because of the nature of their information and the frequency of their actions.

Pack hunters: Predators hunting independently become aware of each other’s activities, and form a pack in order to maximize the chances of triggering a cascading effect

Because of the threat posed by predators, high frequency liquidity providers must be much more tactical … Sometimes they may suddenly pull all orders, liquidate their positions and stop providing liquidity altogether. This decision has more to do with computer science and game theory than it does with valuation fundamentals.

GUI (Graphical User Interface) traders have buttons for sizes with round numbers. HFT algorithms know that if many participants are operating with round numbers in a given moment of the trading session, the market is likely to behave in a particular way.

What does appear clear is that HFT cannot be un-invented, or regulated away, without some severe market effects.

The new paradigm that underlies HFT is not really about speed, so regulatory efforts to slow “cheetah traders” miss the larger point that what is undesirable are particular manipulative strategies and not HFT per se.

This is just one example of how vulnerable the “chronological time” paradigm has made LFTs

Join the herd. Trade with volume bursts, like at the opening and closing of the session, when your footprint is harder to be detected.

Whenever a new predator makes its appearance in a habitat, there is a shock period until the hunted species adapt and evolve.

Rather than seeking “endangered species” status for LFTs (by virtue of legislative action like a Tobin tax or speed limit), it seems more efficient and less intrusive to starve some HFTs by making LFTs smarter.

Read the whole of “The Volume Clock: Insights into the High Frequency Paradigm”.

Hat tip to Marginal Revolution.

image credits

Racing pigeon by maart02 via stock.xchng

Cheetahs from istockphoto.com

“Microstructure” by forwardcom via stock.xchng

Donnely’s Weir by Bjay70 via stock.xchng

Chess by sha7t00t via stock.xchng

Crocodile by tome213 via stock.xchng

Wolves by AinaM via stock.xchng

Faucet by tiano69 via stock.xchng

Gears by svilen001 via stock.xchng

Bloody hand by cahdequech via stock.xchng

Dali clock by kiamedia via stock.xchng

Herd by johnnyberg via stock.xchng

Lions by stellab via stock.xchng

Pandas by thadz via stock.xchng

“…by making LFTs smarter.” care to elaborate a bit more? what do you mean or how do you define “smarter” when LFT usually care about valuation fundamentals which is rather irrelevant in the summary?

Noah,

That’s really a question for the authors of the paper, and they are probably not monitoring this.

But I would think the “smarter” is to do with how to execute the trades that fundamentals (or whatever) suggest rather than changing strategy.