Maximum drawdown is blazingly variable.

Psychology

Probably the most salient feature that an investor notices is the amount lost since the peak: that is, the maximum drawdown.

Just because drawdown is noticeable doesn’t mean it is best to notice.

Statistics

The paper “About the statistics of the maximum drawdown in financial time series” explores drawdown analytically. The interesting part for me is Figures 14 onwards (which start on page 14). The pictures imply that the maximum drawdown could have been pretty much anything.

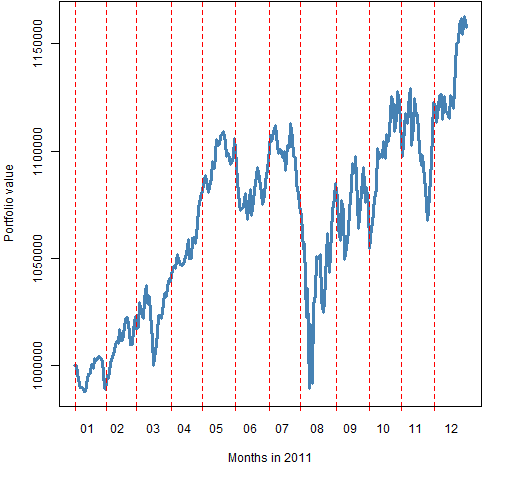

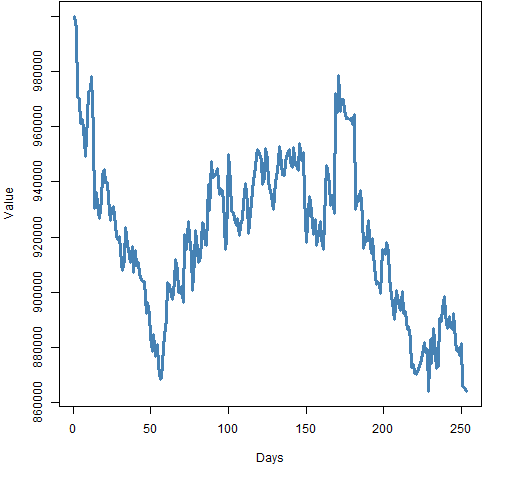

In the post “A minimum variance portfolio in 2011” we explored a particular portfolio. Figure 1 shows its value through 2011. We’ll use this as our example.

Figure 1: The value of the portfolio throughout 2011.

The maximum drawdown of this portfolio is 11.1%.

It is almost true that we shouldn’t care what order the returns arrive in as long as we get the same set of returns over the year. In other words, we should be just as happy with each permutation of the order of the returns of our portfolio.

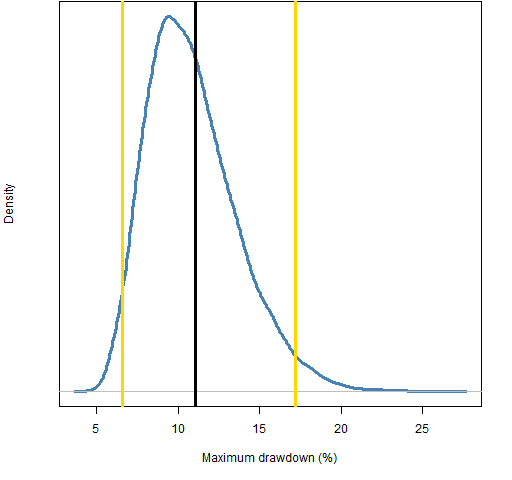

Figure 2 shows the maximum drawdown distribution for random permutations of the returns of our portfolio. Remember that the return over the year is precisely the same for all the portfolios with these drawdowns.

Figure 2: Distribution of maximum drawdown from permutations of the portfolio returns, with 95% confidence interval (gold lines).  We can easily get maximum drawdowns from 7% to 17% using the exact same returns.

We can easily get maximum drawdowns from 7% to 17% using the exact same returns.

Given the big drop at the beginning of August, we might be led to think that the real maximum drawdown would be large relative to the possibilities over the permutations. Actually it is only slightly larger than the mean.

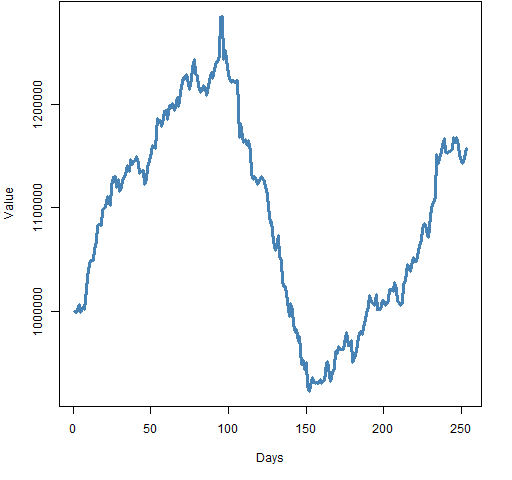

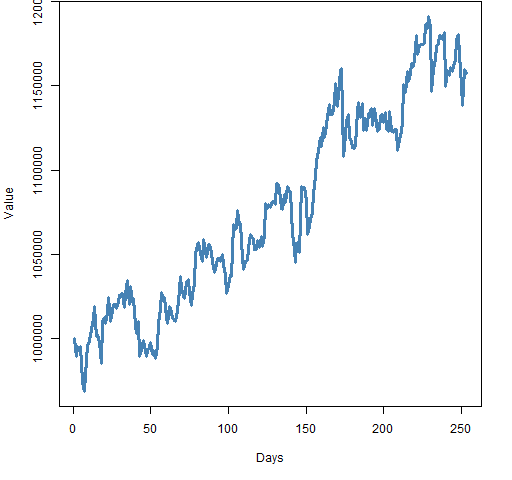

What do worst-case and best-case profiles look like? Figure 3 shows a permutation that comes close to maximizing the drawdown and Figure 4 shows one that comes close to minimizing drawdown.

Figure 3: Permutation of the portfolio returns that produces a large drawdown.

Figure 4: Permutation of the portfolio returns that produces a small drawdown.

Large drawdowns occur when the negative returns are all bunched together. Small drawdowns happen when the negative returns are evenly spread.

Above I said we should be almost indifferent to different permutations of the returns. The catch is that we need to believe that there is neither momentum nor mean-reversion. In Figure 3 we have selected for momentum, and we have selected for mean-reversion in Figure 4.

You may be wondering what the equivalent pictures to Figures 3 and 4 are when the overall return is negative. Obviously the maximum drawdown has to be at least as big as the overall loss. To get big drawdowns the strategy remains the same — push all the negative returns together.

Figure 5 shows an example of minimizing the maximum drawdown when there is an overall loss — create multiple drawdowns of the same size. That is the strategy with overall gains as well, but less obvious on first sight.

Figure 5: Permutation of the negative portfolio returns that produces a small drawdown.

Summary

While maximum drawdown is emotionally compelling, it is not statistically compelling at all. My guess is that trying to ignore it might lead to better investment decisions. Other opinions?

See also

It so happens that Timely Portfolio just had a post on drawdown as well.

Update (2012 July 04): Slides from a talk on a theoretical analysis of drawdown are “An Analysis of the Maximum Drawdown Risk Measure” by Malik Magdon-Ismail.

Epilogue

I’m a poor wayfarin’ stranger

I have nothin’ left to lose

I have fallen down the mountain

Wretched righteous, flesh for fools

from “Down the Mountain” by Robin E. Contreras

Appendix R

There were two R functions written for this. The first computes the maximum drawdown given a wealth curve:

> pp.maxdrawdown

function (wealth)

{

max(1 - wealth / cummax(wealth))

}

If you have simple returns, then you can use the maxDrawdown function from the PerformanceAnalytics package. Note that the use of log returns is not supported — at least currently — in this function.

The second function that was written collects the minimum and maximum of the maximum drawdowns over permutations of the returns:

> pp.collectdd

function (ret, trials=1e4)

{

mind <- Inf

maxd <- -Inf

for(i in 1:trials) {

wealth <- exp(c(0, cumsum(sample(ret))))

td <- pp.maxdrawdown(wealth)

if(td < mind) {

mind <- td

minw <- wealth

}

if(td > maxd) {

maxd <- td

maxw <- wealth

}

}

list(min.drawdown=mind, min.wealth=minw,

max.drawdown=maxd, max.wealth=maxw)

}

There was not much sense in writing a function to get the distribution of maximum drawdowns from permutations — just a couple lines of code sufficed:

> op2.mv.mddd <- numeric(1e4) > for(i in 1:1e4) op2.mv.mddd[i] <- pp.maxdrawdown( + exp(cumsum(c(0, sample(op2.mv.logret))))) > plot(density(op2.mv.mddd * 100))

Very interesting perspective and certainly a different conclusion from mine. I struggle with how to maintain trust and confidence from clients as drawdowns extend beyond 20%. I wish I could just show them your very fine post and expect full commitment. Money management is fairly easy without client psychology. Every money manager generally aspires to only one client–him/herself.

I struggle most with how to get any confidence that drawdown minimization in past environments can be expected to minimize in future situations.

I really look forward to any additional analysis you do on drawdown. Thanks so much for your incredibly fine work.

Thanks for your comments.

I seem to disagree with you on one thing: I think money management is hard enough without client psychology.

I do suspect that you are correct that your clients’ qualms are not going to be calmed on my say-so.

If you think there is anything here that is questionable, please speak up.

Pat,

I’m completely in agreement with your statistical view on the situation.

I thought I would add some color on when paying attention to drawdowns is absolutely required: in the presence of leverage.

I believe that leverage accounts for many of the reasons that drawdowns are a very real, and important, constraint on certain types of portfolios (or portfolios of certain types of instruments)

Regards,

Brian

Brian,

Thanks — very good point.

I hate to break it to you guys but this “random permutations of the returns” is bullshit.

It’s what Monte Carlo does, under the wrong assumption that the order of trades (or returns) doesn’t matter. IN FACT IT DOES MATTER.

You can’t just destroy the order of returns, delude yourself with confidence intervals, and think you have something. You don’t.

If this kind of self delusion is appealing to you, it makes it even more clear that you guys are not real profitable traders with a clue, like me.

I did work with MC in my own backtesting and concluded that it’s totally useless, especially to get a feel for future drawdowns. It won’t help you. Even if the order of trades were random (it’s not), using MC this way is done with the assumption that past distribution of trades is identical to future distribution — again wrong because the market changes.

What has actually helped me as a real trader was to disable a filter of my trading system. I realized that having developed a rule to filter trades introduces bias since I chose one that got it somewhat lucky in the past, although it does have intrinistic value, too (I’m a skilled developer).

So I disabled the filter and got a much larger DD. Even a lot larger than with MC 95% confidence BS. I rightly concluded I had a rsiky system that needed stricter risk management guidelines and has to be traded with low leverage.

Using my ingenuity, I came up with my own test that told me much more about the risk of my system than MC BS. I can do this because I actually trade, I know what’s important and what’s not.

The problem with quant finance is that too many practitioners ignore the Prime Directive from Math Stats 101: thou shalt not estimate beyond the data. Of course, they do so all the time.

There is a second problem: gambling (and folks, putting money in financial instruments is just that; it’s not investing) on the stock market isn’t determined by past experience as described by any number of data streams, but by real events in the real world (it’s not Brownian or any other automaton) which haven’t happened yet. You can predict those, to some degree. You just have to know what to look for.

Those who understood the housing market knew it would blow up by looking at some simple data: the ratio of median house price to median income. The ratio began to get unglued in 2003, and those who paid attention saw this. Without this in your model, you got hosed.

Short term money movements can be used to do short term gambling, and HFT was born. Don’t assume that such number crunching amounts to an Oracle at Delphi in any other venue or time frame.

And, of course, from a trader’s point of view, what matters is identifying the local maxima/minima and positioning accordingly. Whether data streams can tell one that is the lingering question. 2008 says: the pros believed their own propaganda and got it horribly wrong.

It’s quite interesting how maxDDs bring together all the real significant issues in money management: leverage, client relationships and amount of risk you take.

Practically, everybody (i.e. your clients) cares about the particular trajectory that gets realized, but obviously multiple universes exist out there so you can end up in any single one of them. I guess what really matters is the structure of the set of universes and random permutations MC certainly impose artificially simple structure on the universe (as Pat points out momentum and mean-reversion). That’s where we get to something much more ephimeral such as human sentiment. Clearly, strong opinions/emotions increase clustering in returns and lack of above lead to general state of mean-reversion (maybe with weak trend). So, in my mind maxDDs is clearly related to the ‘confidence’ of market participants. The closest proxy that comes to mind is the VIX or some transformation of since it’s more of a fear index rather than anything else.

Quite often we’d call figure 3, high vol/beta stock (I know they are not the same), and figure 4 low vol/beta one. Hence, I will make a far fetched hypothesis lottery seeking behaviour induces larger maxDD trajectories and I guess reverse is true for smaller maxDDs. Maybe the conclusion is that maxDD makes sense only if you clear state your assumptions about future market ’emotions’.

I just finished reading and trying to replicate the paper in R. I’m close, but believe I am missing something. Has anyone else replicated? I will post code once I get it cleaned up.

Pingback: automated forex trading strategies

Interesting paper http://papers.ssrn.com/sol3/papers.cfm?abstract_id=1686115 on Portfolio Optimization and Long-Term Dependence that uses a form of Rescaled Range analysis to address the issue of long-range dependence. It would be interesting to see if you get different results on the distribution of drawdowns using this approach.

Peter,

Thanks for the reference.

Pingback: Review of ‘Thinking, Fast and Slow’ by Daniel Kahneman | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics