How much turnover is required to get portfolios back to their constraints?

Previously

“Low (and high) volatility strategy effects” created 6 sets of random portfolios as of 2007 and showed their performance up to about a month ago. This post explores how much turnover it takes to get the portfolios to obey their constraints at the ending point.

Turnover

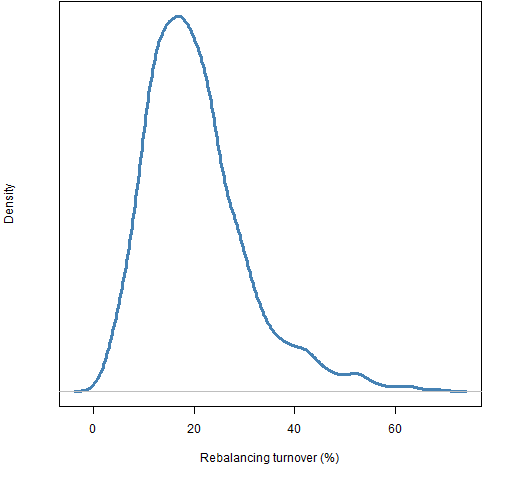

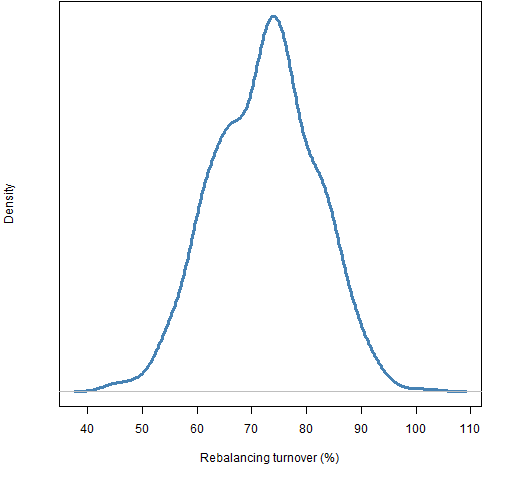

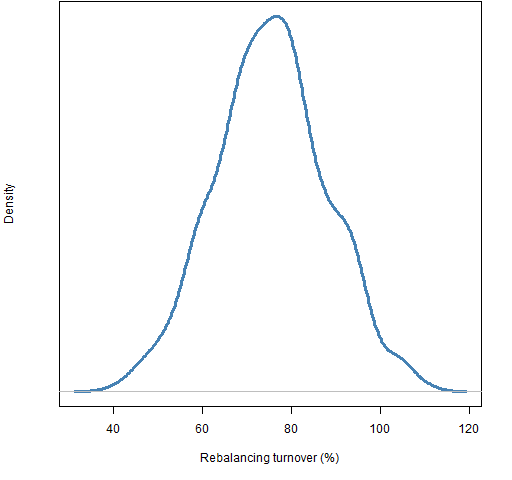

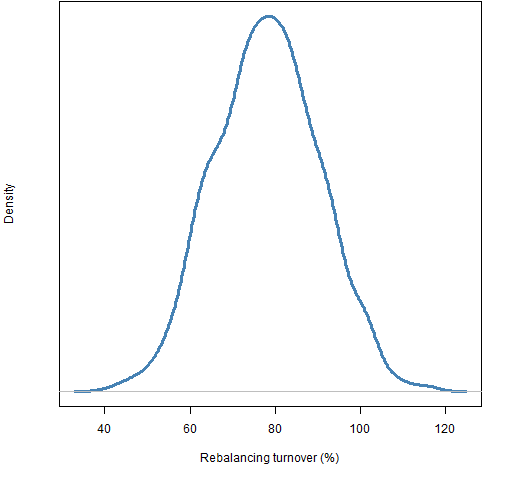

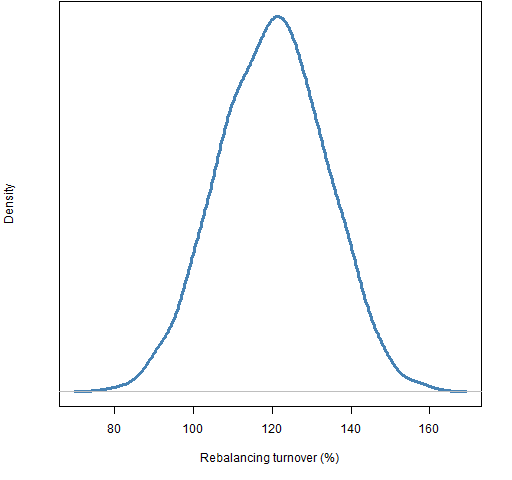

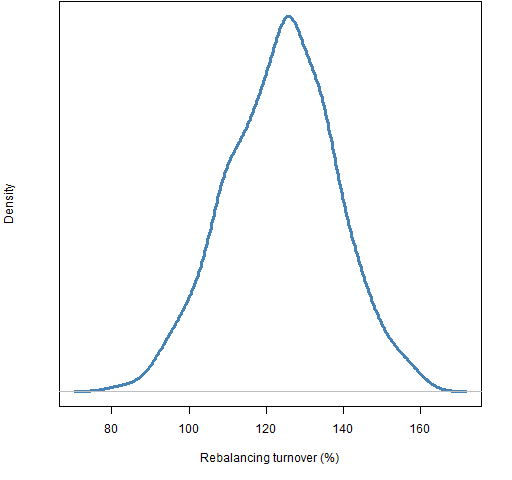

Figures 1 through 6 show the distribution of turnover (buys plus sells) required to move the portfolios back to obeying their constraints in 2012 February.

Figure 1: Distribution of rebalancing turnover for the “vanilla” portfolios.  The only constraint that can be broken in the vanilla portfolios is the maximum weight of 4%. So the turnover in Figure 1 is only from selling off the stocks with too much weight (and buying back other stocks).

The only constraint that can be broken in the vanilla portfolios is the maximum weight of 4%. So the turnover in Figure 1 is only from selling off the stocks with too much weight (and buying back other stocks).

Figure 2: Distribution of rebalancing turnover for the “low variance” portfolios.

Figure 3: Distribution of rebalancing turnover for the “low volatility” portfolios.

Figure 4: Distribution of rebalancing turnover for the “low beta” portfolios.

Figure 5: Distribution of rebalancing turnover for the “high volatility” portfolios.

Figure 6: Distribution of rebalancing turnover for the “high beta” portfolios.

Summary

- All three of the low volatility style cohorts have about the same turnover.

- However, it is possible that “minimum variance” turnover could be sensitive to the 120% allowance we make for the variance constraint.

- The two high volatility style cohorts have turnover similar to each other, and — unsurprisingly — higher than that for low vol.

Portfolio Probe Appendix

utility

When we are rebalancing the random portfolios, we are not aiming at any particular utility. But we do want to minimize the amount of turnover when finding a portfolio that obeys all the constraints.

The mechanism that was used was:

- set all expected returns to zero

- set the trading cost to be the stock price

- set the utility to “maximum return”

- avoid the annoying warning about optimization without a variance with

do.warn=c(novar=FALSE)

This optimization is minimizing the turnover because it is minimizing the cost which is proportional to the turnover. As a bonus the cost of the trade is the fraction of turnover (buys plus sells), so there is no need to make a call to valuation or summary.

universe

Four of the six cohorts involve selecting from a subset of the overall universe. The trick to get the portfolios to obey that type of constraint was:

- set the universe to the union of the names in the portfolio and the names in the new subset that is required

- force closing trades on the assets in the portfolio that are not in the new subset