Conference

The first EARL Conference (Effective Applications of the R Language) was held 2014 September 15-17 in London.

Talk

My talk was “Effective risk management with R” (annotated slides).

Instability hypothesis

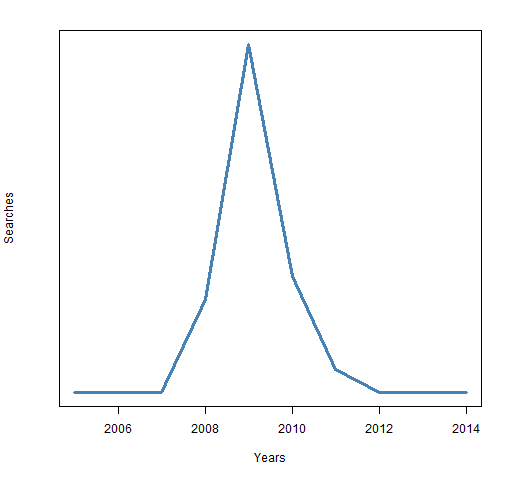

When I was preparing for the talk, one of my ideas was to show the Google trend for searches for Minsky’s instability hypothesis. I thought it would look a lot like Figure 1.

Figure 1: My guess of interest in the instability hypothesis over time.  My impression is that the instability hypothesis is pretty much totally ignored except immediately following market crashes. That’s the sort of thinking that allows the pattern to continue.

My impression is that the instability hypothesis is pretty much totally ignored except immediately following market crashes. That’s the sort of thinking that allows the pattern to continue.

Figure 2: Google trend for: minsky instability hypothesis.

The trend that I actually saw was severely different from my prior. This leads me to pretty much entirely discount the data. Part of the problem is the small number of searches at any time.

Epilogue

I’ll tell ya truly that I sometimes lie

— from “What Kinda Guy?” by Steve Forbert

Pat, I am sorry that I messed up the chorus line. I didn’t know how much it meant to you. Many thanks for publishing your insightful slides. They help me to correct my memory in the meaning of bugs in the context of risk management. I thought you had said: “Bugs are surprises/events I forgot to consider”. But of course it it “Risk management is debugging the investment process.”

Pingback: The Whole Street’s Daily Wrap for 9/21/2014 | The Whole Street

You need a search term that investment professionals might use, like this

https://www.google.com/trends/explore#q=%22minsky%20moment%22

Pingback: Review of “Money, Blood and Revolution” by George Cooper | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics