We look at a few forecasts for the year 2011 that we’ve run across, and compare them with the prediction distributions presented in Revised market prediction distributions.

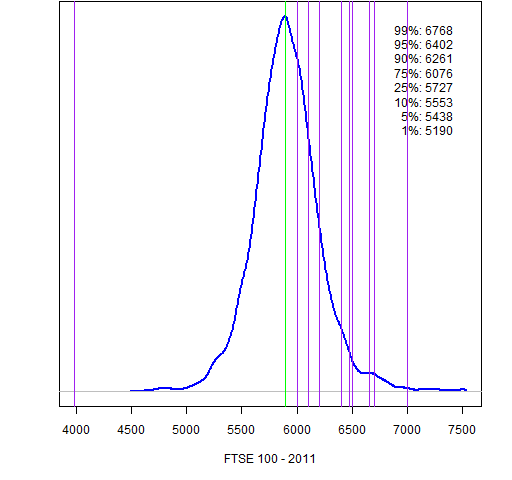

FTSE 100

There is a “range forecast” on an Interactive Investor page of 5350 to 6565. It isn’t clear (to me at least) what this means, but I find it fascinating that it is ever so close to a 95% confidence interval assuming no market movement via my technology. The quantiles of that range are 3.2% and 97.6%.

Table 1: Some 2011 predictions for the FTSE 100.

| person | firm | value | reference |

| Kevin Goldstein-Jackson | 3,980 | webpage | |

| Jaskarn Pawar | Investor Profile | 6,000 | webpage |

| Andrew Swallow | Swallow Financial | 6,100 | webpage |

| David Stevenson | 6,200 | webpage | |

| Danny Cox | Hargreaves Lansdown | 6,400 | webpage |

| Peter Temple | 6,475 | webpage | |

| Melvyn Bell | Lowes Financial Management | 6,500 | webpage |

| Justin Urquhart Stewart | Seven Investment Man. | 6,660 | webpage |

| Martin Bamford | Informed Choice | 6,700 | webpage |

| Nick Louth | 7,000 | webpage |

Figure 1: FTSE 100 (UK) 2011 prediction distribution with predictions.

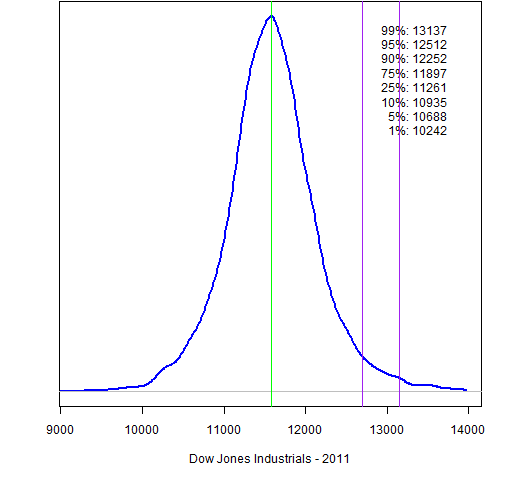

Dow Jones Industrials

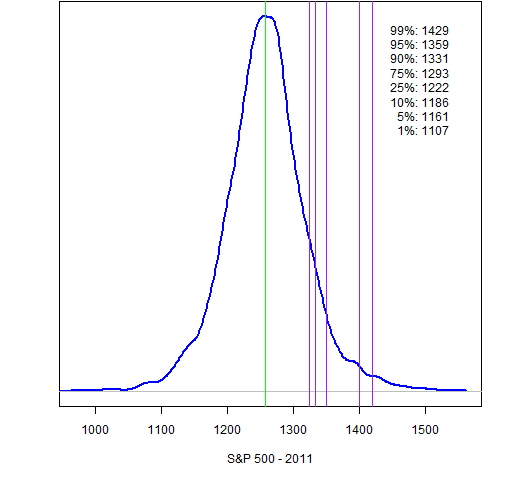

A range for the Dow Jones of 10,300 to 12,750 is predicted by tradersir. That corresponds to quantiles of 1.4% to 97.3% in my distribution. Ranges are also given for the S&P 500: 1100 (0.9%) to 1400 (98.0%).

Table 2: Some 2011 predictions for the Dow Jones Industrials.

| person | firm | value | reference |

| E. Thomas McClanahan | Kansas City Star | 12,700 | webpage |

| Tobias Levkovich | Citi | 13,150 | webpage |

Figure 2: Dow Jones Industrial Average (USA) 2011 prediction distribution with predictions.

S&P 500

Table 3: Some 2011 predictions for the S&P 500.

| person | firm | value | reference |

| Jonathan Golub | UBS | 1,325 | webpage |

| Laszlo Birinyi | Birinyi Associates | 1,333 | webpage |

| Robert Doll | Blackrock | 1,350 | webpage |

| Tobias Levkovich | Citi | 1,400 | webpage |

| Barry Knapp | Barclays | 1,420 | webpage |

Figure 3: S&P 500 (USA) 2011 prediction distribution with predictions.

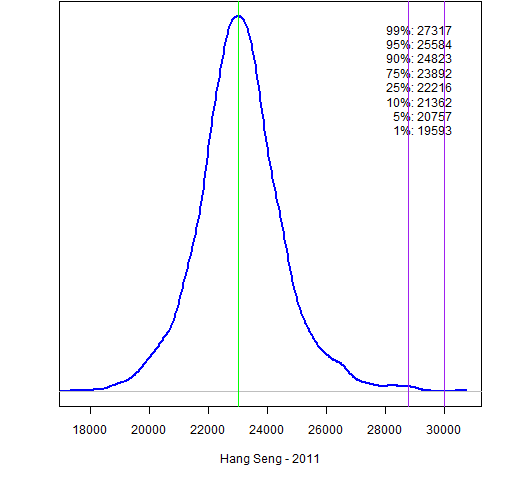

Hang Seng

Table 4: Some 2011 predictions for the Hang Seng.

| person | firm | value | reference |

| median of 13 | The Standard survey | 28,800 | webpage |

| Kingston Lin King-kam | OSK Asia | 30,000 | webpage |

Figure 4: Hang Seng (Hong Kong) 2011 prediction distribution with predictions.

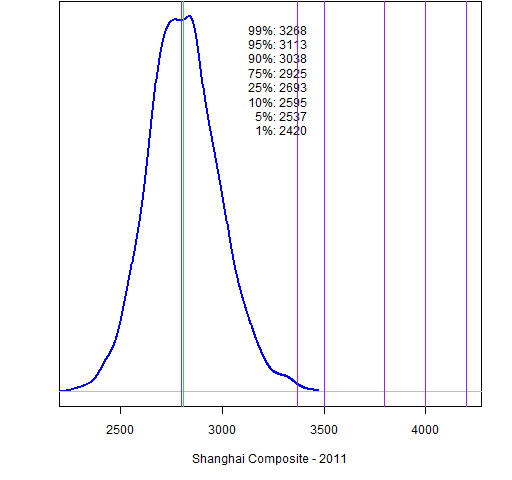

Shanghai Composite

Table 5: Some 2011 predictions for the Shanghai Composite.

| person | firm | value | reference |

| Guotai Junan | 2,800 | webpage | |

| JPMorgan | 3,370 | webpage | |

| Citic Securities | 3,500 | webpage | |

| Haitong Securities | 3,500 | webpage | |

| Shenyin & Wanguo | 3,800 | webpage | |

| Galaxy Securities | 4,000 | webpage | |

| Sinolink Securities | 4,200 | webpage |

Figure 5: Shanghai Composite (China) 2011 prediction distribution with predictions.

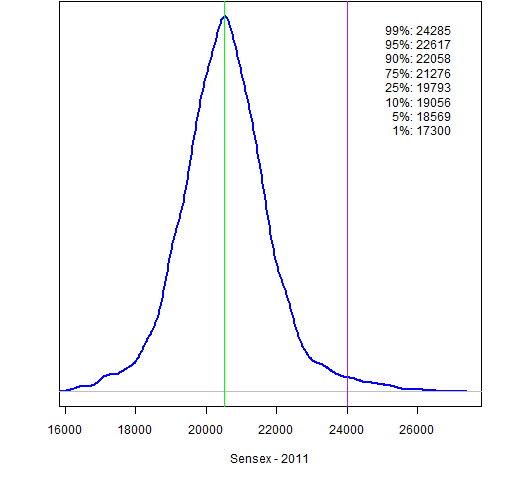

Sensex

Table 6: Some 2011 predictions for the Sensex.

| person | firm | value | reference |

| K. K. Mittal | Globe Capital | 24,000 | webpage |

Figure 6: Sensex (India) 2011 prediction distribution with predictions.

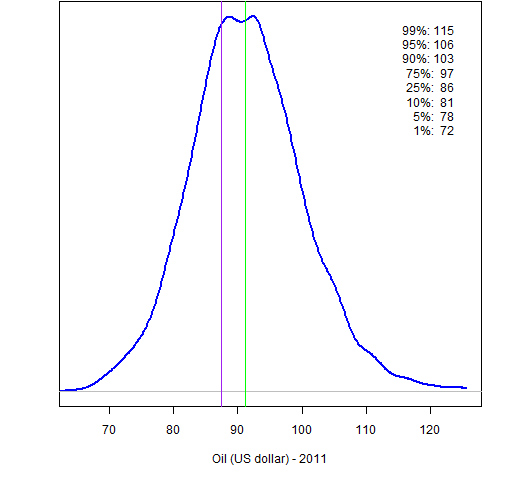

Oil price

Table 7: Some 2011 predictions for oil price.

| person | firm | value | reference |

| Deutsche Bank | 87.5 | webpage |

Figure 7: Cushing OK contract 1 (US dollar) 2011 prediction distribution with predictions.

Epilogue

Figures may be reproduced with attribution.

Appendix R

The tables are created automatically by R from the data frames that hold the data for the predictions. I just copy the R output and paste it into the html editing window. The xtable package is almost suitable for that, but (as far as I can tell) it doesn’t allow the html commands to go through unaltered. So I wrote a little function (pp.htmltable) to do what I wanted.

Yet again you can get the R functions that are used via the R command:

> source('https://www.portfolioprobe.com/R/blog/prediction_dist_funs.R')

On one use of this command, I received:

Error in file(file, "r", encoding = encoding) :

cannot open the connection

In addition: Warning message:

In file(file, "r", encoding = encoding) :

unable to resolve 'www.portfolioprobe.com'

However, that was just a temporary glitch.

I should have pointed out in the post a couple of other recent blog posts on predictions.

World Beta A roundup of market forecasts

which refers to

A Dash of Insight Big names, big market calls

We predict 1400 for S&P cash.

http://www.hedgefundlive.com/blog/market-predictions-new-years-resolutions-and-the-year-that-was-2010-all-employees-must-wash-hands-and-read-this-blog#comments