Summary

Look at the usefulness of constraints.

Description

When we constrain our portfolios, we are in effect buying insurance — we are willing to forgo upside in order to reduce downside. Random portfolios provide a means of seeing the costs and benefits of the constraints.

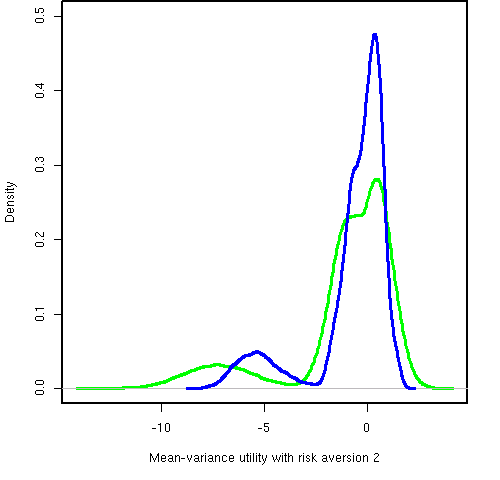

Figure 1: Utility under two sets of constraints

Figure 1 shows an example of such an analysis. The green distribution is for a certain set of constraints. The blue distribution is for the same set of constraints plus a maximum volatility constraint. This was done over the years 2007 and 2008 so there was a crisis period as well as more normal times. We look to be fairly indifferent to the volatility constraint during normal times but it was very useful during the crisis.

Market Synopsis

Axioma has “constraint attribution” that attempts to parse the effect of each of a set of constraints.

The advantage of Axioma’s approach is that it handles all of the constraints at once. The disadvantage is that it depends on a model.

The key advantage of using random portfolios is the transparency of what is being done.