How do volatility estimates based on monthly versus daily returns differ?

Previously

The post “The mystery of volatility estimates from daily versus monthly returns” and its offspring “Another look at autocorrelation in the S&P 500” discussed what appears to be an anomaly in the estimation of volatility from daily versus monthly data.

In recent times estimates of volatility from monthly data appear smaller than volatility estimated from daily data. Hypotheses about what is happening include:

- There is autocorrelation in the returns

- There is some sort of garch effect

- There is no real discrepancy, just noise

The data

The data used in the present analysis are daily log returns on the S&P 500 starting at the beginning of 1989. This is broken into 7 blocks each of length 800 trading days — so slightly more than 3 years. 800 because it is divisible by 5 (weekly) and 20 (monthly).

The estimates for these blocks from several time scales are shown in Table 1.

Table 1: Volatility estimates with returns of different lengths (in days) for the 7 blocks.

| B1 | B2 | B3 | B4 | B5 | B6 | B7 | |

| 1 | 14.4 | 9.1 | 13.9 | 21.4 | 19.6 | 12.5 | 29.7 |

| 2 | 14.4 | 9.1 | 13.6 | 20.8 | 19.1 | 11.6 | 29.8 |

| 5 | 15.1 | 8.4 | 12.0 | 19.2 | 21.5 | 11.2 | 23.9 |

| 10 | 14.4 | 7.0 | 11.6 | 19.5 | 21.4 | 9.6 | 23.5 |

| 20 | 14.4 | 7.2 | 12.0 | 17.2 | 21.9 | 10.4 | 22.5 |

| 40 | 15.0 | 6.5 | 9.8 | 15.0 | 15.5 | 10.0 | 27.0 |

The effect looks quite noisy in Table 1. Perhaps there is nothing to investigate, but let’s persevere.

GARCH

A problem with volatility is that it is unobservable. Using garch models can sort of help that — they give us an estimate of volatility for each time point. Table 2 shows the results we get by averaging the garch estimates of volatility within each block.

Table 2: Volatility derived from garch models of returns of different lengths (in days) for the 7 blocks.

| B1 | B2 | B3 | B4 | B5 | B6 | B7 | |

| 1 | 14.7 | 10.0 | 13.6 | 20.9 | 18.6 | 12.3 | 25.4 |

| 2 | 14.7 | 10.3 | 13.6 | 20.2 | 18.0 | 11.9 | 25.0 |

| 5 | 15.5 | 10.1 | 12.4 | 19.0 | 20.0 | 11.4 | 22.4 |

| 10 | 15.2 | 9.9 | 12.4 | 19.1 | 21.1 | 10.7 | 22.2 |

| 20 | 15.1 | 11.6 | 13.6 | 16.6 | 21.5 | 12.3 | 21.7 |

| 40 | 15.2 | 11.7 | 13.2 | 14.5 | 16.3 | 12.5 | 21.3 |

The effect looks smaller here, but there are hints that it hasn’t disappeared entirely.

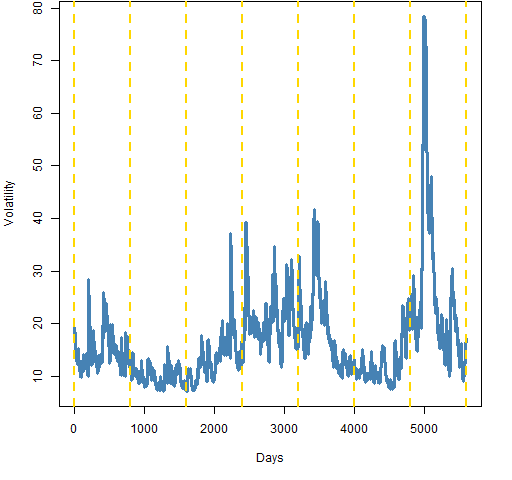

If garch does explain the phenomenon (should it exist), then I would have expected how volatility acts within each block to matter. Figure 1 shows the garch volatility, but I don’t see a connection.

Figure 1: GARCH volatility based on 1-day returns.

Cycles

When we aggregate the daily returns into longer time periods, the particular days that go together can matter. Perhaps all we are seeing is that the estimates with returns from longer time frames are noisier and hence we happen to have seen small ones sometimes.

We can test this by moving the starting point through a cycle. The way it was done here was to paste the unused values at the start onto the last data point. So there is one artificial data point in all but one of the cycles, but the same 800 daily returns are used in each case. We then get a distribution of volatility estimates.

We can create a different distribution which runs through the cycles but first does a random permutation of the daily returns. With this distribution we know there is no autocorrelation. But we are also destroying the volatility clustering, so we can’t distinguish between those two hypotheses.

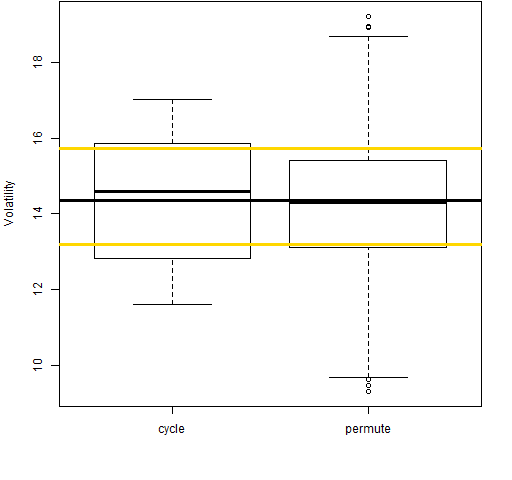

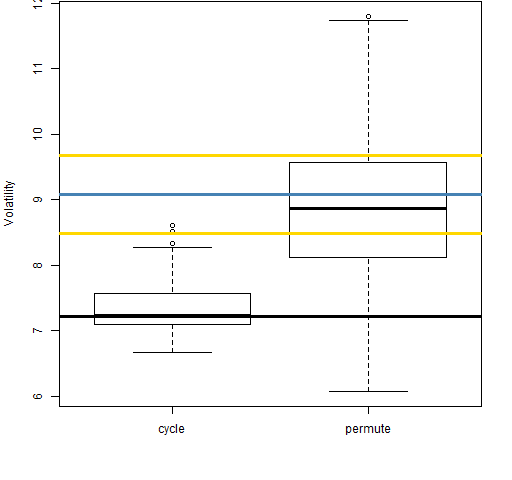

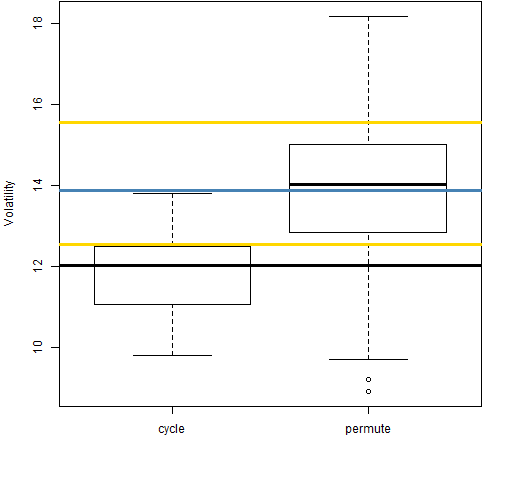

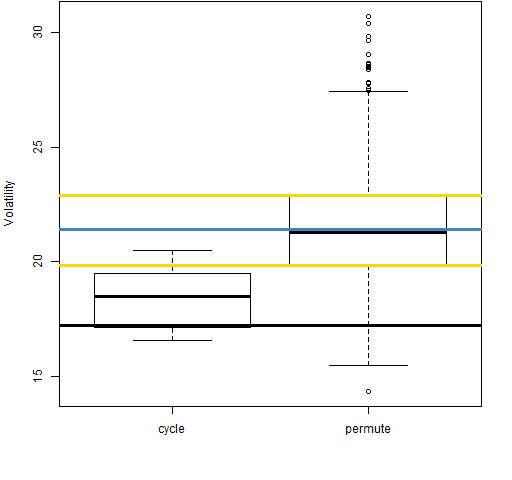

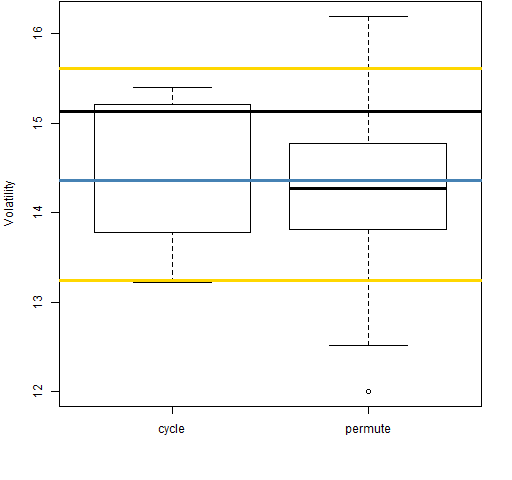

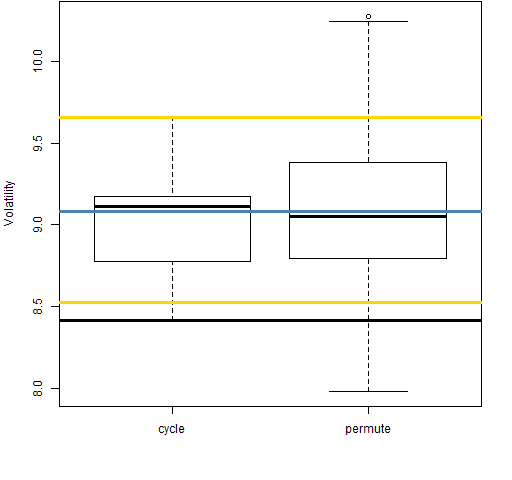

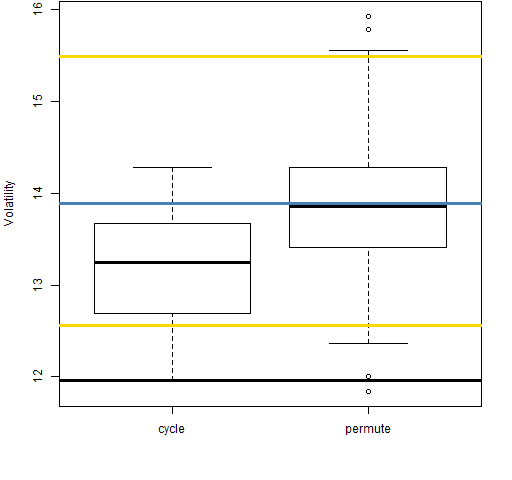

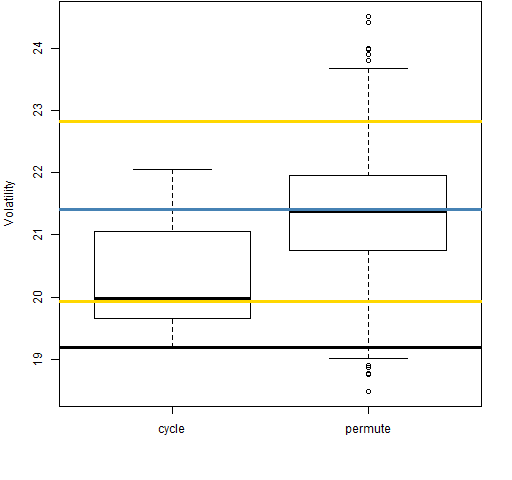

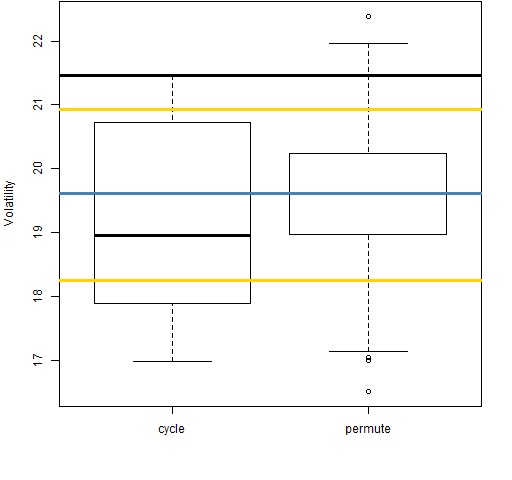

The subsequent figures include:

- a boxplot of the volatility estimates from aggregations of the actual daily returns (denoted “cycle”)

- a boxplot of the volatility estimates from aggregations of permuted daily returns (denoted “permute”)

- the volatility estimate from the daily returns (horizontal blue line)

- the 95% bootstrap confidence interval of the daily volatility estimate (horizontal gold lines)

- the actual volatility estimate from aggregated data that appears in Table 1 (horizontal black line)

Figure 2: Volatility estimate distributions for 20-day returns on block 1 (1989-01-03 to 1992-03-02).  In Figure 2 we see the behavior that we would expect. Both boxplots are pretty much centered on the estimate from the daily returns. The actual estimate from the aggregated data happens to be very close to that from the daily data, but it could have been quite far away. This shows that the estimates with monthly data are substantially more variable than those from daily data.

In Figure 2 we see the behavior that we would expect. Both boxplots are pretty much centered on the estimate from the daily returns. The actual estimate from the aggregated data happens to be very close to that from the daily data, but it could have been quite far away. This shows that the estimates with monthly data are substantially more variable than those from daily data.

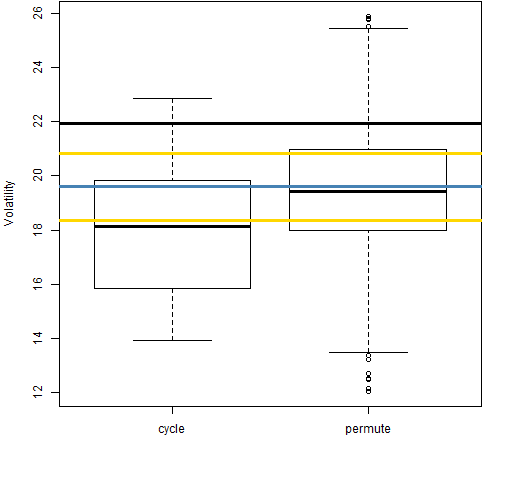

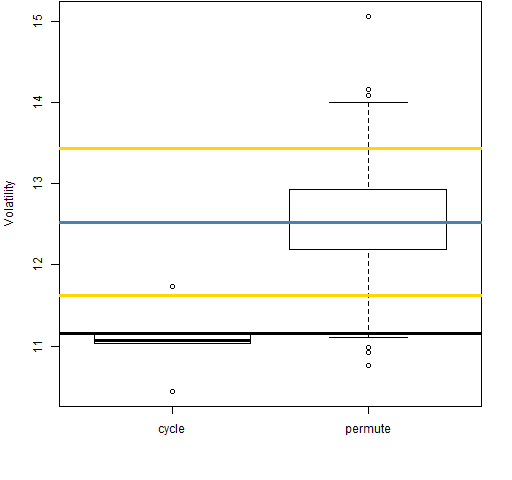

Figure 3: Volatility estimate distributions for 20-day returns on block 2 (1992-03-03 to 1995-05-01).  In Figure 3 we see the typical pattern: the estimate from the aggregated returns is smaller than either the daily estimate or aggregation with permuted returns.

In Figure 3 we see the typical pattern: the estimate from the aggregated returns is smaller than either the daily estimate or aggregation with permuted returns.

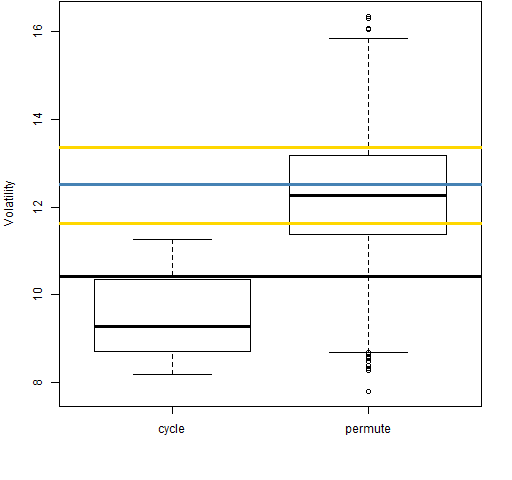

Figure 4: Volatility estimate distributions for 20-day returns on block 3 (1995-05-02 to 1998-06-30).

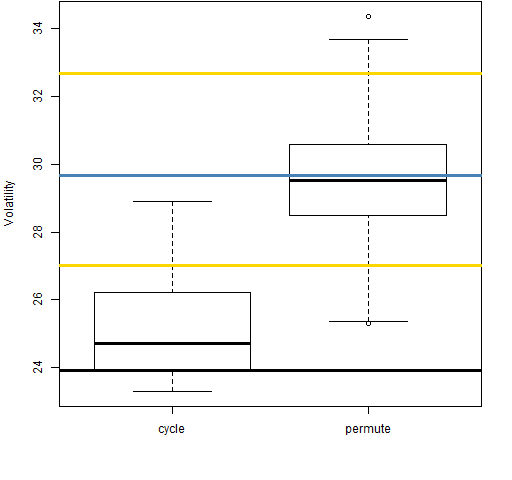

Figure 5: Volatility estimate distributions for 20-day returns on block 4 (1998-07-01 to 2001-08-30).

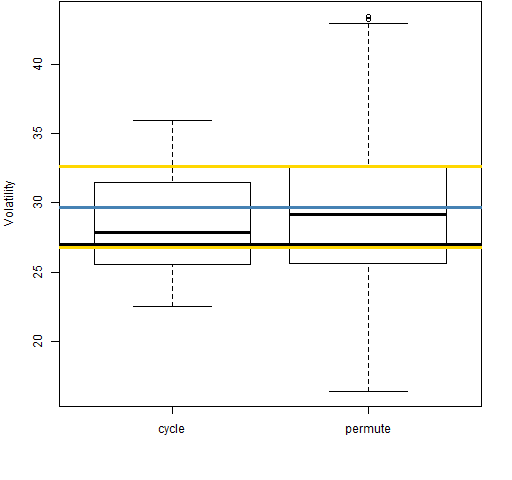

Figure 6: Volatility estimate distributions for 20-day returns on block 5 (2001-08-31 to 2004-11-09).

Figure 7: Volatility estimate distributions for 20-day returns on block 6 (2004-11-10 to 2008-01-15).

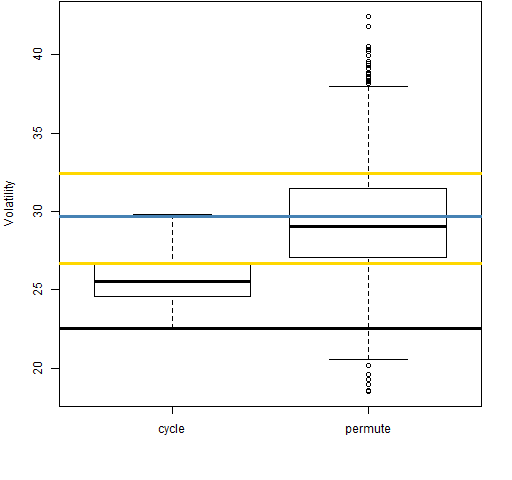

Figure 8: Volatility estimate distributions for 20-day returns on block 7 (2008-01-16 to 2011-03-18).  Figures 2 through 8 showed the situation for aggregations to 20 days. Figures 9 through 15 are of aggregations to 5 days. In these cases the “cycle” boxplots are only representing 5 datapoints rather than 20.

Figures 2 through 8 showed the situation for aggregations to 20 days. Figures 9 through 15 are of aggregations to 5 days. In these cases the “cycle” boxplots are only representing 5 datapoints rather than 20.

Figure 9: Volatility estimate distributions for 5-day returns on block 1 (1989-01-03 to 1992-03-02).

Figure 10: Volatility estimate distributions for 5-day returns on block 2 (1992-03-03 to 1995-05-01).

Figure 11: Volatility estimate distributions for 5-day returns on block 3 (1995-05-02 to 1998-06-30).

Figure 12: Volatility estimate distributions for 5-day returns on block 4 (1998-07-01 to 2001-08-30).

Figure 13: Volatility estimate distributions for 5-day returns on block 5 (2001-08-31 to 2004-11-09).

Figure 14: Volatility estimate distributions for 5-day returns on block 6 (2004-11-10 to 2008-01-15).

Figure 15: Volatility estimate distributions for 5-day returns on block 7 (2008-01-16 to 2011-03-18).  There seems to be an anomaly within the anomaly in that the 40-day aggregation for block 7 displays “good” behavior as shown in Figure 16.

There seems to be an anomaly within the anomaly in that the 40-day aggregation for block 7 displays “good” behavior as shown in Figure 16.

Figure 16: Volatility estimate distributions for 40-day returns on block 7 (2008-01-16 to 2011-03-18).

Summary

I think what’s been shown here is that there really is a phenomenon to explain. But we haven’t yet pinned down an explanation.

There is the hypothesis that infinite variance could be the cause of the weird behavior. I don’t believe that the variance is infinite; but if it were, I don’t think that would cause what we’ve seen here as the variance would be infinite in all cases.

Questions

How do we test if volatility clustering is causing the effect?

Epilogue

And something is happening here

But you don’t know what it is

Do you, Mister Jones ?

from “Ballad of a Thin Man” by Bob Dylan

Appendix R

There are two main parts to this analysis:

- garch estimation

- cycling, permuting and bootstrapping

garch estimation

The garch models were estimated like:

require(rugarch)

gs1t <- ugarchfit(ugarchspec(distribution='std'), spxretd1)

This estimates a garch(1,1) model assuming the residuals have a Student’s t distribution. It also assumes an ARMA(1,1) process for the mean. The exact specification seems to make essentially no difference for our purposes. Since we are only interested in the in-sample volatility, pretty much any semi-reasonable garch coefficients would probably do.

A basic version of Figure 1 is:

plot(sigma(gs1t) * 100 * sqrt(252), type='l')

The estimation of garch models is a surprisingly tough task. I’ll not recommend any garch software without thoroughly investigating it. But getting similar garch coefficients whether the returns are in their natural scale or in percent is comforting.

cycling, permuting and bootstrapping

Some functions were written to do these tasks, and are listed (with rather bizarre formatting) in volatility_est_funs.R.

paste and cut and paste

A labor-saving device to put the dates of the blocks into the figure captions was to paste (in the R sense) the dates together into strings, and then to cut and paste (in the GUI sense) those into the captions. The R code was:

jjb <- seq(1, by=800, length=7)

paste(' (', names(spxretd1)[jjb], ' to ', names(spxretd1[jjb+799]), ')', sep='')

Pingback: Monday links: away from our screens | Abnormal Returns

A (shy) reader points to “Reference-Day Risk and the Use of

Monthly Returns Data: A Warning Note” by Acker and Duck.

Great data analysis. I have also noticed and been interested in this phenomenon. I wanted to clear up something:

The variance discrepancy IS negative (realized) autocorrelation. If the daily (log) returns are uncorrelated, then the variances MUST be the same, regardless of the time window that you use to measure them. So if the variances aren’t the same, then there is autocorrelation. If we are talking about data, then the negative autocorrelation is realized. If we are talking about distributions, then yes some statistical tests for significance are appropriate. However, the effect is that of integrated autocorrelation (e.g. over a month), so it may not appear significant in an AR(1) model.

This is not a new effect, however. It has been noticed in the finance literature since way back, and is very robust, across international equity markets. I recently read this paper by Poterba and Summers from 1988, http://www.albany.edu/faculty/faugere/PhDcourse/meanreversion1.pdf

where they investigate the power of the variance ratio (ratio of variance measure with different sample windows) in tests, and data from world equity markets, looking at various horizons. Nearly all markets exhibited this phenomenon. I believe they show that the AR(1) model has less power than the variance ratio to detect autocorrelation. It should be of interest.

Also, a previous comment from Gappy is not correct. He said: “Autocorrelation tests are often misleading because users often apply them automatically without examining the assumptions. For example, you may have positive/negative autocorrelation even if returns are iid and lognormal, but you have a stochastic (unobservable) drift.”

Again, you can’t have even uncorrelated, much less independent, returns, of any distribution and have autocorrelation. Its true that you can have autocorrelation with log-normal returns with stochastic drift. To get that tho, the returns couldn’t be independent (the stochastic drift is a component of the return).

The horizon-dependence of variance is potentially important because it offers a partial explanation for the outperformance of rebalanced portfolios over their non-rebalanced counterparts, over sufficiently long horizon. E.g. as in

http://www.qfrc.uts.edu.au/research/research_papers/rp281.pdf

There are clearly other reasons for the outperformance also, which I won’t get into here.

I’m currently trying to give a more precise mathematical description of precisely how this slight but robust, persistent, and non-negligible negative autocorrelation affects rebalanced portfolio returns. Then we can have a good model for understanding its implications in portfolio construction. The research is still in the early stages tho.

Best,

Winslow

Winslow,

Thanks for the references. Autocorrelation is a possibility but not the only one. There is the volatility clustering hypothesis which Table 2 seems to support at least to some degree. There are also other possibilities, such as that proposed in the next comment by Joseph.

There is a potential explanation here: http://www.entsophy.net/blog/?p=6

Note the effect probably wouldn’t arise if stocks were traded every day of the year.

Joseph,

Thanks very much — extremely interesting.

There is a huge literature on volatility dynamics, starting from ARCH/GARCH specification in the 80s and alive today with realized volatilities estimators from high frequency data.

A model I quite like is the “volatility cascade” one, summarized for instance here :

http://homepage.sns.it/marmi/lezioni/corsi-pisa-2010.pdf

Unlike most others, there is an attempt to link the stylized facts with some economic behaviour, instead of simply fitting a model to the data.

Pingback: Backtesting Minimum Variance portfolios « Systematic Investor

Pingback: Volatility estimation and time-adjusted returns | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

Pingback: Blog year 2011 in review | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

Pingback: Volatility from daily or monthly: garch evidence | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

Our mission at vape4style.com is to give our clients along with the best vaping expertise possible, helping them vape snappy!. Located in New York City as well as in organisation considering that 2015, we are actually a custom-made vaping supermarket offering all kinds of vape mods, e-liquids, pure nicotine salts, skin devices, tanks, coils, and other vaping add-ons, such as batteries as well as exterior chargers. Our e-juices are actually always fresh due to the fact that our company certainly not only market our items retail, but additionally circulate to local area NYC shops in addition to give wholesale options. This permits our team to continuously turn our sell, delivering our consumers as well as outlets with the absolute most best inventory possible

.

Our team are an special Northeast Yihi distributor. We are likewise authorized suppliers of Negative Drip, Harbour Vape, Charlie’s Chalk Dirt, Beard Vape, SVRF by Saveur Vape, Ripe Vapes, Smok, Segeli, Dropped Vape, Kangertech, Triton and also much more. Do not observe something you are trying to find on our website? Certainly not a issue! Only let our company know what you are actually trying to find and we will certainly locate it for you at a affordable price. Possess a inquiry concerning a particular item? Our vape specialists will certainly rejoice to supply additional details about anything our team sell. Only send our team your inquiry or even phone our company. Our group will definitely rejoice to aid!

If you are a vaper or even making an effort to get off smoke, you are in the best spot. Want to conserve some money present? Hurry and also join our email subscriber list to acquire exclusive club VIP, vape4style markdowns, promos as well as free giveaways!

wanderlust e-liquid bazaar : charlies chalk dust

https://jariosos.com/lisazere janiphoti xymenes a30b5ac58e